What Is an Itemized Receipt

Reggie Jacobs

Founder of Receipt Maker & Document Management Expert

An itemized receipt lists every product or service in a transaction with individual prices. Learn why it's essential for tax deductions, reimbursements, and audits.

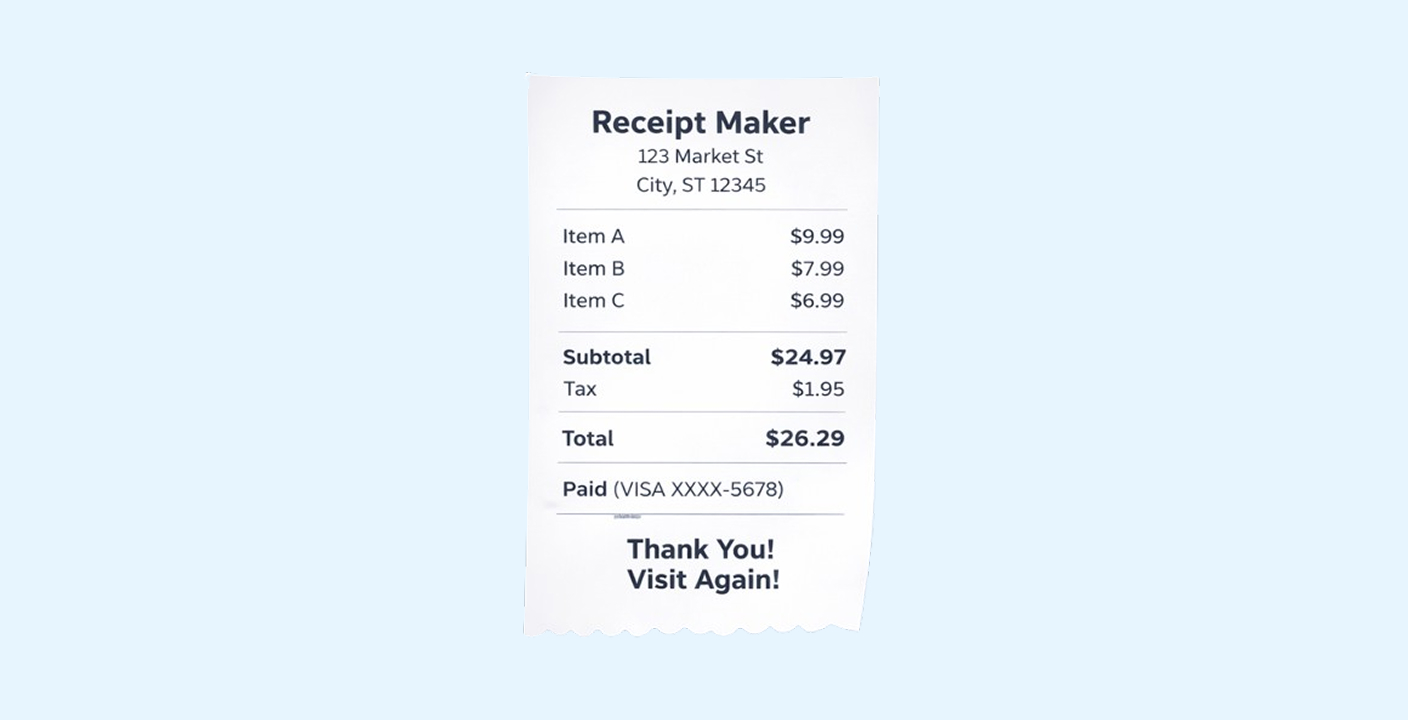

What Makes a Receipt "Itemized"

An itemized receipt must include: vendor name & address, date & time, item descriptions with quantities, unit prices, tax breakdown, and total amount.

- A credit card slip only shows the total—not valid for audits

- Required for expenses over $75 by the IRS

- Always request itemized copies at point of sale

- Go digital immediately to prevent fading

Itemized receipts are simpler than they sound. However, they are also the single most important document for your business finances.

Imagine you just got back from a business trip. You have a wallet full of paper slips. You hand them to your finance team or your accountant, and they hand them right back. They tell you the credit card slip isn't enough. They need to see exactly what you bought.

If you cannot produce the right document, you might be stuck paying that bill yourself.

This guide breaks down exactly what an itemized receipt is, why you need one, and how to manage them so you never lose money on an expense again.

Understanding Itemized Receipts

An itemized receipt is a detailed proof of purchase that lists every product or service bought in a transaction. It does not just show the total amount paid. It breaks down the cost of each individual unit.

Think of it as the "full story" of a transaction. A standard credit card slip only tells you how much you paid. An itemized receipt tells you what you paid for.

This distinction is massive. The IRS and most company finance departments require this level of detail to prove that a purchase was a legitimate business expense and not a personal splurge.

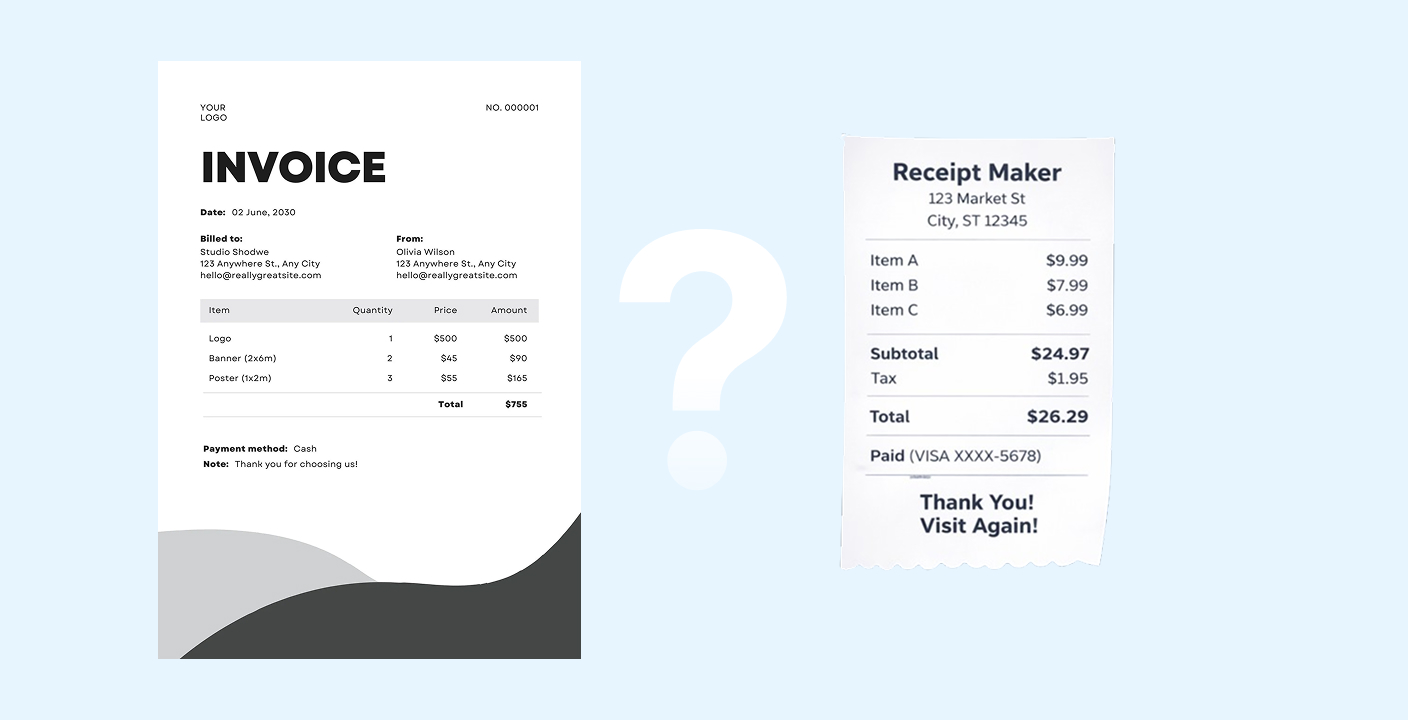

Itemized Receipt vs. Regular Receipt: What is the Difference?

It is easy to confuse these two. You get a piece of paper after you pay, so you assume you are safe. That is a dangerous assumption.

A regular receipt (often called a credit card slip) usually only shows the total, the date, and the merchant's name. It confirms money changed hands.

An itemized receipt goes deeper. It proves the nature of the expense.

The Restaurant Example:

A regular receipt from a restaurant shows you paid $150.00.

An itemized receipt shows you ordered three steaks, two sparkling waters, and one bottle of wine.

If your company policy forbids expensing alcohol, the regular receipt makes it look like you are hiding something. The itemized receipt proves compliance (or lack thereof).

Here is a quick way to compare them:

| Feature | Regular Receipt (Slip) | Itemized Receipt |

|---|---|---|

| Total Amount | Yes | Yes |

| Date & Time | Yes | Yes |

| Merchant Name | Yes | Yes |

| List of Items | No | Yes |

| Price Per Item | No | Yes |

| Tax Breakdown | Rarely | Yes |

| Valid for Tax Audits | No | Yes |

What Details Must Be Included?

Not all receipts are created equal. If you are looking at a slip of paper and wondering if it passes the test, look for these specific details. To be considered "itemized," it must include:

- Vendor Name and Address: This proves who you paid and establishes legitimacy.

- Date and Time: This matches the expense to a specific accounting period or trip.

- Item Descriptions: Specific names of products or services (e.g., "Canon Printer" vs. "Merchandise").

- Quantity and Unit Price: The cost per item.

- Subtotals, Taxes, and Fees: The math that leads to the final number.

- The Grand Total: The final amount charged.

- Payment Method (Optional but helpful): Shows if it was cash, credit, or corporate card.

Why They Are Important (And When They Are Required)

You might think digging for a detailed receipt is a waste of time. It turns out that skipping this step is one of the easiest ways to lose money.

1. Reimbursements

If you are an employee, your company likely has a policy that requires itemized receipts for anything over a certain dollar amount (usually $25 or $75). If you submit a generic slip, they will kick it back. You will be left paying for a business expense out of your own pocket.

2. Tax Deductions

The IRS is strict. They need to know that the computer you bought is for the office and not for your home. A credit card statement only shows you spent $1,500 at Best Buy. An itemized receipt proves you bought a laptop for work. Without that proof, your deduction could be denied.

3. Audits

In the event of an audit, itemized receipts are your best defense. They act as concrete evidence. Auditors look for this level of detail to approve expenditures officially.

4. Fraud Prevention

Itemized receipts prevent financial misstatements. They provide a clear record of what was purchased, which reduces the risk of embezzlement or employees sneaking personal items into business expenses.

Industry-Specific Scenarios

Different industries rely on itemized receipts for different reasons. Here is how it breaks down in the real world:

Business Travel

Hotels are complex. An itemized folio splits out room charges, room service, internet fees, and taxes. Only some of those may be reimbursable under your company policy.

Client Meals

You need to separate food from alcohol. This helps businesses comply with tax rules (meals are often deductible differently than entertainment) and internal policies.

Construction & Trade

Itemized supply receipts help you code costs to specific projects. You can match the lumber purchase to "Project A" and the drywall to "Project B."

Transportation & Fuel

Fuel receipts often need to show gallons, price per gallon, and the total. This data is critical for certain tax reporting and mileage tracking.

How to Request an Itemized Receipt

Sometimes you get one automatically. Sometimes you have to work for it.

At the Point of Sale

Always ask for an "itemized copy" before they print the receipt. Most modern POS systems have a button for this.

After the Purchase

If you forgot, call the vendor. Most businesses can reprint a receipt from their system if you provide the date, time, and card number used.

Do It Yourself (The Fallback)

If a digital itemized receipt is impossible to get, you can sometimes scan the standard receipt and manually list the purchases in your expense report notes. This is a last resort and takes more time, but it offers more context than a blank total.

Common Challenges and Best Practices

Managing these receipts can be a pain. Receipts get lost. Ink fades. Humans make errors.

Here is a simple workflow to keep your financial life in order:

- Go Digital Immediately. Do not wait until the end of the month. Snap a photo of the receipt the moment you get it.

- Use Dedicated Folders. Create a system. Store receipts in folders labeled by date or category. This makes it easy to find them if you get audited three years from now.

- Review Regularly. Set a routine to check your receipts for accuracy. Catching an error (like a wrong tip amount) is much easier the day after it happens than six months later.

- Know the Policy. Understand your company's expense policy. Know the submission timelines and what is considered reimbursable. When you know the rules, you stop chasing paperwork that doesn't matter.

Make a Receipt with Receipt Maker

What if you are the vendor? Or what if you lost a receipt and need to recreate the data for your own records?

You can use our tool to solve this.

Receipt Maker allows you to plug in the date, merchant, items, and taxes to generate a perfect itemized receipt in seconds. It ensures all the mandatory fields are there so your documentation is audit-proof.

Summary

Managing expenses is rarely fun. However, understanding the difference between a simple payment slip and a full itemized receipt is the key to keeping your money.

An itemized receipt tells the full story. It lists the individual items, the taxes, and the specific costs. This detail is required for tax deductions, employee reimbursements, and fraud prevention.

Get the details right. Snap the photo. Save the file. Your future self will thank you when tax season arrives.

FAQ

Can a credit card statement serve as an itemized receipt?

Generally, no. A statement only proves a payment was made. It does not prove what was purchased. The IRS typically requires the actual receipt for expenses over $75, but keeping them for everything is the safest bet.

What if I lose an itemized receipt?

Try contacting the vendor first. If that fails, you can use a bank statement combined with a written note explaining the expense. This is riskier for audits but better than nothing.

Does a handwritten receipt count?

Yes, as long as it contains all the necessary information (Vendor, Date, Items, Prices, Total). However, digital receipts are preferred because they are harder to fake and easier to read.

Why do companies strictly require itemized receipts?

It is about compliance and transparency. They need to verify that the expense aligns with company policy (e.g., no alcohol, no personal items) and ensure they can legally deduct the expense on their taxes.

Related Articles

Invoice vs Receipt: What's the Difference?

An invoice requests payment before money changes hands. A receipt confirms payment after it's complete. Mixing them up can delay payments and cause tax audit problems.

How to Organize Receipts for Business in 2026

A disorganized receipt system costs the average small business owner 40+ hours per year. Here's a proven system you can set up in under an hour.