Invoice vs Receipt: What's the Difference?

Reggie Jacobs

Founder of Receipt Maker & Document Management Expert

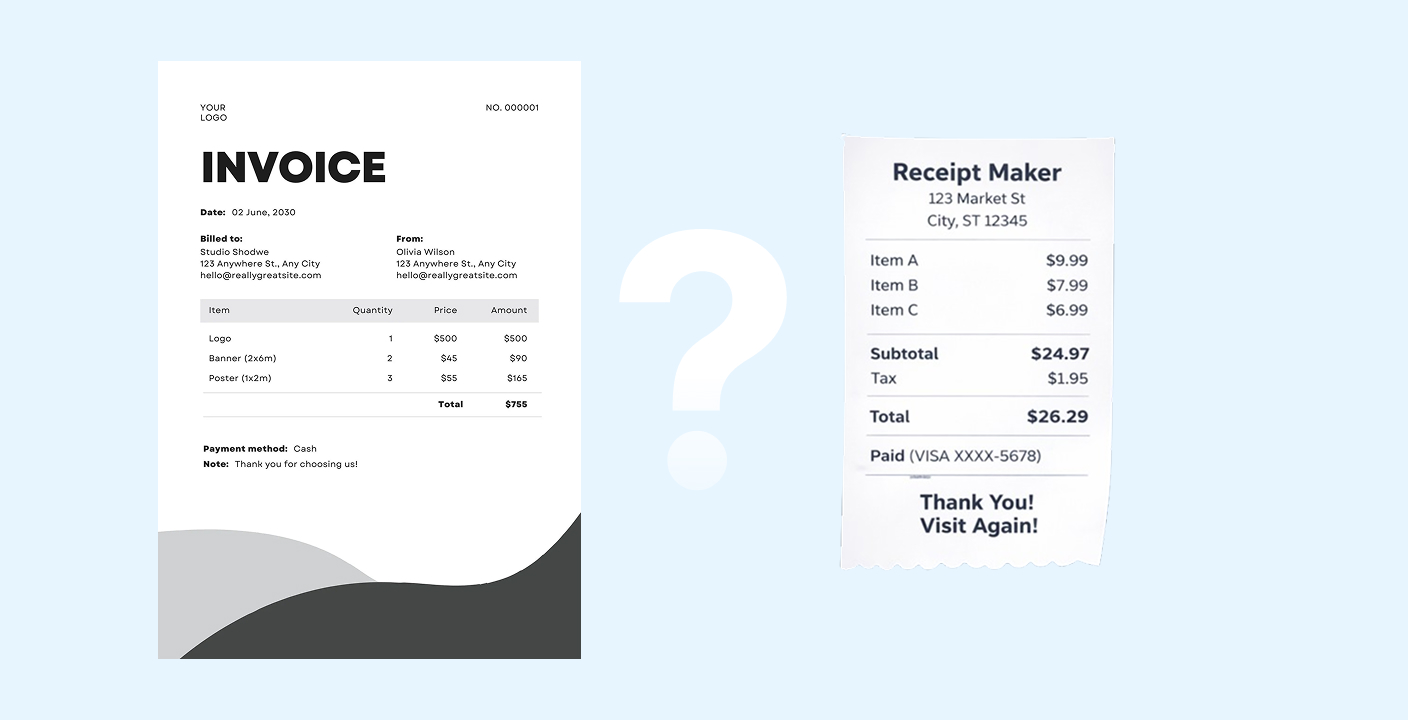

An invoice requests payment before money changes hands. A receipt confirms payment after it's complete. Mixing them up can delay payments and cause tax audit problems.

Invoice vs Receipt at a Glance

Invoice = Request for payment (sent before you get paid) Receipt = Proof of payment (sent after payment is received)

- Invoices create "Accounts Receivable" in your books

- Receipts are required for tax deductions and expense reports

- Never use an invoice as proof of payment in an audit

- Always issue receipts to clients after payment clears

You know the feeling. It is tax season. You are staring at a mountain of digital files and crumpled papers. You see "Invoice #3002" and "Receipt #404" and for a split second you wonder if they are the same thing. Can you use the invoice as proof of expense? Did you actually send a receipt to that client who paid you last month?

Mixing these two up is a classic mistake. It happens to freelancers, small business owners, and even experienced founders. But getting it wrong can mess up your bookkeeping and annoy your customers.

Here is the good news. The distinction is actually very simple once you see it laid out.

This guide will clear up the confusion so you can get back to building your business.

The Short Answer

An invoice is a request for payment. You send this before you get money. It tells your customer what they owe you and when it is due.

A receipt is proof of payment. You send this after you get the money. It confirms that the transaction is complete and the debt is settled.

Think of it like a restaurant meal. The bill they bring to your table is the invoice. The slip of paper they hand you after they swipe your credit card is the receipt.

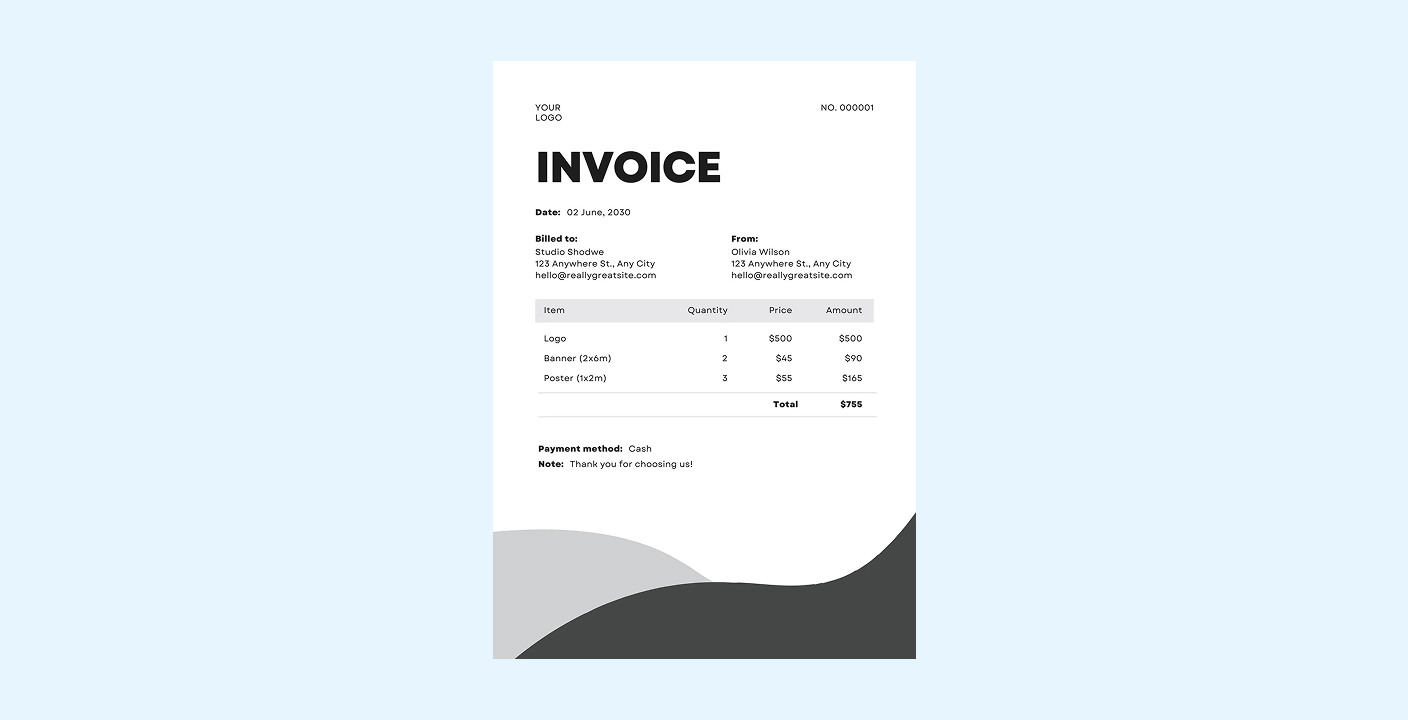

What Is an Invoice?

An invoice is a formal document you send to a client or customer. It lists the goods you sold or the services you provided. Its primary job is to tell the customer: "You owe me this much money, and please pay it by this date."

In the B2B (business-to-business) world, invoices are the standard way to get paid. You rarely pay upfront for a consulting gig or a bulk order of raw materials. You get the work or the goods first, then you get the invoice, and then you pay.

When do you use an invoice?

You issue an invoice when you have completed the work or delivered the product but haven't received the cash yet. It tracks the sale and creates an "Accounts Receivable" entry in your books. This means money is owed to you.

What must an invoice include?

To look professional and get paid faster, your invoice needs specific details:

- The word "Invoice" clearly displayed at the top

- A unique invoice number for tracking

- Date of issue and the due date

- Seller and Buyer information (names, addresses, contact info, company details)

- Itemized list of services or products (quantities, unit prices)

- Subtotal, taxes, and total amount due

- Payment terms (like "Net 30" or "Due on Receipt")

Pro Tip: Being vague on invoices is the #1 reason payments get delayed. Don't just write "Consulting." Write "Website Redesign Project - Phase 1."

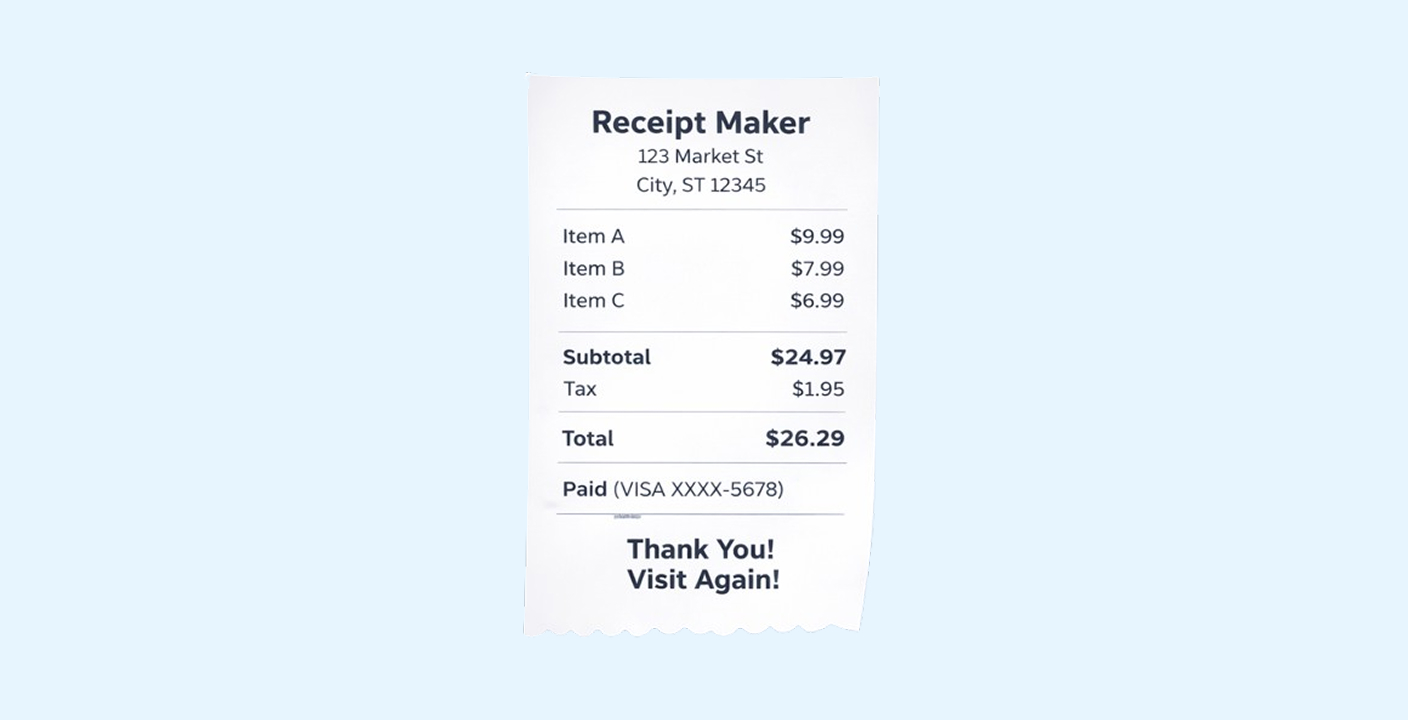

What Is a Receipt?

A receipt is a document that proves a payment happened. It is the closing handshake of the transaction. Once money changes hands, the receipt serves as the legal record for both the buyer and the seller that the obligation has been met.

For the buyer, the receipt is vital. It is how they prove business expenses to the tax authorities. Without a receipt, they cannot claim the deduction.

When do you use a receipt?

You issue a receipt immediately after the payment is processed. If you run a coffee shop, you hand it over instantly. If you are a freelancer, you might email a digital receipt automatically once the client's bank transfer hits your account.

What must a receipt include?

Receipts are generally simpler than invoices but still need accuracy:

- The word "Receipt" or "Payment Confirmation"

- Seller details

- Date of payment

- Total amount paid

- Method of payment (Credit Card ending in 1234, Cash, PayPal)

- Invoice number reference (if this receipt is paying off a specific invoice)

The Core Differences: Invoice vs. Receipt

It helps to see the comparison side-by-side. Here is exactly how they stack up against each other.

| Feature | Invoice | Receipt |

|---|---|---|

| Primary Purpose | Request payment | Confirm payment |

| Timing | Issued before payment | Issued after payment |

| Action Required | Customer must pay | No action (record keeping only) |

| Accounting Entry | Accounts Receivable (Money owed) | Cash / Revenue (Money received) |

| Key Phrase | "Please pay this amount" | "You have paid this amount" |

A Real-World Example

Let's look at a scenario to make this concrete. Imagine you run a graphic design agency called "Pixel Perfect."

Step 1: The Work

You finish a logo design for a client, "TechStart Inc."

Step 2: The Invoice

You send a PDF document to TechStart. It is titled Invoice #101. It lists "Logo Design Package: $2,000" and says the payment is due in 15 days.

- Status: You have done the work. You are waiting for cash.

Step 3: The Payment

TechStart's finance manager gets the invoice. They approve it and wire $2,000 to your bank account.

Step 4: The Receipt

Your accounting software sees the money come in. It automatically emails a document to TechStart titled Receipt #555. It says "Payment of $2,000 received on Oct 12th via Bank Transfer."

- Status: The transaction is closed. TechStart saves this receipt to prove they spent the money on business.

Why Getting This Wrong Costs You Money

This isn't just about being pedantic with words. Confusing these documents creates real operational headaches.

1. Tax Audits and Deductions

The IRS and other tax agencies are strict. If you try to claim a business expense but only have an invoice, they might reject it. An invoice only proves someone asked for money. It does not prove you paid it. You need the receipt (or a bank statement matched to the invoice) to bulletproof your deductions.

2. Double Payments

If you mistakenly send an invoice again when the client asked for a receipt, they might get confused. Their accounts payable department might think it is a new charge and pay you twice. While extra cash sounds nice, refunding it is a hassle and makes you look disorganized.

3. Professionalism

Sending a receipt when a client asks for an invoice delays your payment. They literally cannot pay you until they have the proper invoice to process in their system. Knowing the difference speeds up your cash flow.

Organizing Your Documents

This is where knowing how to organize receipts for business becomes critical. You should keep two separate digital folders or distinct tags in your accounting software:

- "To Pay" (Invoices received)

- "Paid" (Receipts and paid invoices)

Don't let them mix. If you mix unpaid invoices with receipts, you risk missing a bill payment or thinking you have more cash on hand than you actually do.

Here is a video explaining the difference between receipts and invoices:

Frequently Asked Questions

Can an invoice serve as a receipt?

No. An invoice shows intent to pay, not actual payment. However, if you stamp an invoice with "PAID" and include the date and method of payment, it can function as a receipt. Many digital systems do this automatically by updating the original invoice status to "Paid."

Do I need to issue a receipt if I already sent an invoice?

It is best practice, yes. While a bank record proves money left the account, a receipt ties that money specifically to the goods or services. Corporate clients usually mandate receipts for their expense reports.

Is a credit card slip a receipt?

Yes. The slip you get from a card terminal is a receipt. It contains the date, amount, and merchant info. However, for large business purchases, you should also ask for an itemized receipt that lists what you bought, not just the total.

What if I lose a receipt?

If you lose a receipt, contact the vendor immediately. Most businesses can reprint or resend a digital copy of a past transaction. For tax purposes, a bank statement can sometimes substitute for small amounts, but don't rely on it for major expenses.

Related Articles

What Is an Itemized Receipt

An itemized receipt lists every product or service in a transaction with individual prices. Learn why it's essential for tax deductions, reimbursements, and audits.

How to Organize Receipts for Business in 2026

A disorganized receipt system costs the average small business owner 40+ hours per year. Here's a proven system you can set up in under an hour.